Where once the choice of headquarters locations was limited to historically strategic centers, new hubs offer economic and geographical advantages. Theresa Bobis from DE-CIX, on putting Iberia first on the list for location strategies in 2025.

Costs of production, supply chains and logistics capabilities, access to talent, or amenable tax rates: There are many reasons for re-evaluating a company’s location strategy. In a globalized business world, an efficient and effective geographical footprint impacts a company’s efficiency, revenues, and resilience. In the digital age, geographical positioning has become even more critical, because the speed of data exchange between company locations and relevant external (e.g. cloud and application) networks is dependent on connecting to high-performance digital infrastructure.

Therefore, one element that must not be neglected in assessing a company’s location strategy is the quality and density of digital infrastructure in potential localities. Continual growth in new digital hubs is offering companies greater choice for new settlements, as well as for redundancy options. Where once the choice of headquarters locations was limited to a few historical centers, new locations are beginning to emerge, demonstrating a range of economic, infrastructural, and geographical advantages that can have a positive impact on not only the supply chain and digital strategy, but also a company’s sustainability. One of these is the Iberian Peninsula.

For European companies, and for global companies seeking a European footprint, there has been a tendency to congregate in the large historical digital hubs of Frankfurt, London, Amsterdam, and Paris (the FLAP markets) to gain access to the digital ecosystems there. A digital hub of this kind brings together a dense landscape of data centers, clouds, and networks, combined with the interconnection services of a range of Internet Exchanges (IXs), to enable optimal conditions for digital work and life. Through the aggregation of infrastructure, such a hub supports companies in accessing the networks and services they need in the best possible performance. Today, we see new options emerging: Digital hubs like Madrid, Lisbon, and Barcelona offer not only the benefits of their own locations, but also the bundled power and density of the entire Iberian Peninsula.

Optimized connectivity to the whole world

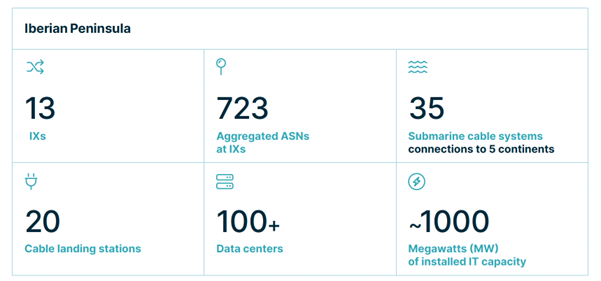

As DE-CIX’s recently published studies “The Iberian Peninsula: A next-generation regional mega hub” and “Portugal: a global interconnection hub, a gateway to Europe, a gateway to the world” clearly demonstrate, Iberia can be considered pretty much the center of the digital world. Situated on the shores of the Atlantic and the Mediterranean, it abounds in sub-sea cable infrastructure connecting five continents in unbeatable latency. The peninsula boasts 35 international submarine cable systems and 20 cable landing stations (CLSs). Global latencies from Lisbon attest to its centrality, with 16 milliseconds (ms) latency to Casablanca, 40ms to Lagos, 60ms to Washington DC, 60ms to Fortaleza, 70ms Dubai, and 140ms to Singapore. This enables the optimization of global traffic flows, with Iberia well situated as an alternative pathway for international north-to-south, south-to-south, and east-to-west data traffic.

Business advantages of the Iberian Peninsula

Aside from its role in global data flows, Iberia is an interesting market in its own right, with a population of close to 60 million and leading levels of 5G deployment to support modern use cases. The peninsula is home to a distributed data center market comprising over 100 data centers with many more in planning, with terrestrial connectivity crisscrossing Iberia and connecting it to the rest of Europe. A healthy higher education sector ensures the pipeline for new talent to support the insatiable global demand for skilled workers, and the temperate climate and lifestyle contribute to its retention. The peninsula is home to an extensive network of high-speed trains as well as multiple maritime ports, and the Madrid-Barajas Airport is capable of handling up to 70 million passengers per year. It is a regional mega hub – not just for data flows, but for all business needs.

Cloud service providers have long since understood the attractiveness of the Iberian Peninsula, with enormous investments being poured into the region over the last few years and multi-billion Euro investment announcements again in 2024. And if we just look at Madrid, we can see why the clouds have felt the need to settle in the region: Madrid is home to the headquarters of most large Spanish companies, with 65% of Spanish multinationals having their central base in the city, along with more than 7000 foreign companies. The city is one of the top five cities in Europe with the most operational headquarters of multinational companies from the Fortune Global 500. Madrid also places fifth in Europe of the cities that lead in terms of economic output, diversity, and growth potential, making it a captivating hub for business and investment. Since 2016, Madrid has experienced a notable 23.24% growth in its GDP, to reach €261.7 billion in 2023.

The regional mega hub of the Iberian Peninsula

What is it about the Iberian Peninsula that makes it so unique? Not only does it have global centrality for sub-sea cables, it also has highly distributed infrastructure on land. Together with the hubs of Madrid, Lisbon, and Barcelona, additional infrastructure markets that also play their own roles in the formation of the Iberian regional mega hub include Bilbao, Valencia, Malaga, the Aragon region, Porto, and Sines. The combined strengths of this dynamic cluster of hubs and infrastructure markets means that Iberia should be at the top of the list for all companies searching for a new location for headquarters and branches. With around 17ms latency from Madrid to Paris, 14ms from Barcelona to Rome, and 18ms from Barcelona to Geneva, and around 30ms to destinations in Germany, according to https://wondernetwork.com/pings, Iberia can also function strategically for network operators to improve the resilience of connectivity for central and southern Europe. Here, a location on the Iberian Peninsula can complement locations in the FLAP markets to ensure the highest level of resilience.

The peninsula is also home to a strong distributed interconnection market. A total of 13 IXs – most of them in Madrid, Lisbon, and Barcelona – allow optimization of traffic flows and direct interconnection with local, regional, and international networks, while providing opportunities for the growing demand for redundancy on the IX level. The aggregated ASNs connected to these IXs have mushroomed since 2016, growing by around 1200% and reflecting the accelerating importance of the region for network operators.

DE-CIX’s interconnected ecosystem of IXs in Iberia, as well as in Marseille in Southern France, provides the foundations for excellent connectivity across the region. The company’s IXs in Southern Europe provide seamless interconnection across the regional mega hub and through to DE-CIX IXs in central and northern Europe, across the Atlantic to its North American IXs, as well as south to the African and east to the Middle Eastern and Asian exchanges DE-CIX operates. These IXs enable companies the best connectivity performance to local cloud regions and application networks, as well as to cloud service providers and network operators not yet present in Iberia.

How Iberia can support sustainability strategies

The region also offers abundant opportunities to power data centers with renewable energy, largely from hydro, photovoltaic, and wind power production. Spain and Portugal are both leaders in the production of regenerative energy, and a range of data center operators and cloud providers are already taking advantage of the climatic advantages to power their data centers. Power purchase agreements (PPAs) have been signed by multiple colocation providers in Spain and Portugal to power their data centers with 100% renewable energy. The city of Sines in Portugal, for example, is witnessing the construction of what is planned to be the largest renewable energy data center complex in Europe, the Start Campus SINES. In addition, the major cloud players on the ground in Iberia are sourcing renewable energy on the peninsula. We see great potential for Iberia to become a carbon-free AI hub for Europe, capitalizing on the abundant space, relatively low cost of land, and renewable energy power generation capabilities.

Enterprises are capitalizing on Iberia’s benefits

To sum up, enterprises are moving to the Iberian Peninsula, capitalizing on the benefits that Iberia has to offer. The Iberian Peninsula is globally unique in its infrastructure and geographical advantages. Not simply a landmass bordering the Atlantic and the Mediterranean, it is an interconnected cluster of hubs and individual infrastructure markets, focused around the strong digital hub of Madrid. For companies looking to gain greater efficiencies, control their global data flows, and ensure connectivity resilience, Iberia should have pride of place on the list of key locations in European and global location strategies.