For centuries, banks have played an key role in the economic cycle. They accept savings deposits from private households and keep fiscal assets safe, they provide companies and private individuals with capital in the form of loans, and they support corporate and municipal infrastructure investments, etc. But traditional banking activities and standard services no longer provide enough of a business case to support this role. Banks have been feeling the pinch for more than a decade now. They need to reduce their costs, develop new business models, activate new revenue streams beyond the standard set of financial services, and meet the needs and expectations of increasingly tech-savvy customers.

In recent years we see the trend for companies to want to cover the entire lifecycle of their customers, in whichever industry they are operating. For banks, this move would provide opportunities to offer a wider portfolio of services to their customers, developing new revenue streams and evolving into the one-stop shop for their customers’ every need. This will require banks to become fully digitalized and to interact with a wider range of stakeholders across sectors.

To achieve this strategic goal, banks need to take a different approach to managing their data – these bits and bytes are the basic commodity of the digital age.

Becoming the one-stop shop for the customer journey by controlling the data journey

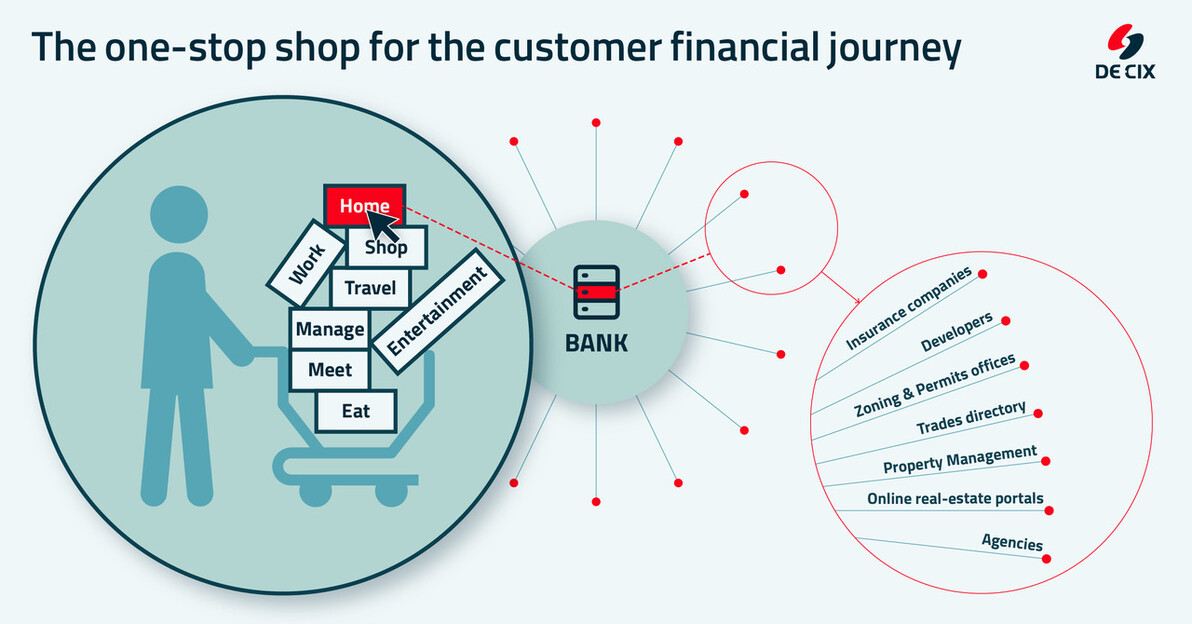

Analysts, observers and growth strategists point out that banks are notoriously conservative when it comes to digital innovation and extoll the benefits of digitalizing banks. Instead of providing financial services that feed into other vertical industries, such as real estate, retail, or automotive, banks can themselves become the moderator of the entire customer journey through these sectors. At the same time, through digital architectures, they can develop the capacity to sell their products to a wider range of customers through third-party providers. And instead of competing head-on with the FinTechs and tech giants, they want to be able to capitalize on the benefits of partnerships. These ambitions become possible if the banks digitalize their processes and services intelligently.

Making the evolutionary leap to become the one-stop shop for the customer journey requires banks to take control of the digital infrastructure they use to connect with their partners and manage their data. Banks need secure and high-performance direct connections to all of their partners – be that insurance companies, FinTechs, payment services and credit card companies, property developers, investment companies, accountants, or business consultancies, just for a start.

Having set up this connectivity with partners, a bank can then embed itself more and more deeply into each of the value chains represented. Take as an example real estate loan management: Formerly, banks made their money on the interest on money lent. Today, instead of just providing the mortgage, some banks are also earning from real estate brokerage, and providing a platform for further trusted real estate services (architectural, insurance, etc.), thus becoming the one-stop shop for the customer’s real estate journey. This concept can be applied to all vertical industries: in whatever sectors banks are lending to customers or working with existing partners, they can deepen their involvement in the value chain.

Mitigating risks to reap the benefits of digital banking

But banks are wary of taking risks. They want – and are compelled by regulations worldwide to have – the highest level of security and reliability in all of their digital processes. They need the best possible digital performance, with the lowest possible ‘latency’ (response time), to ensure transactions are processed seamlessly.

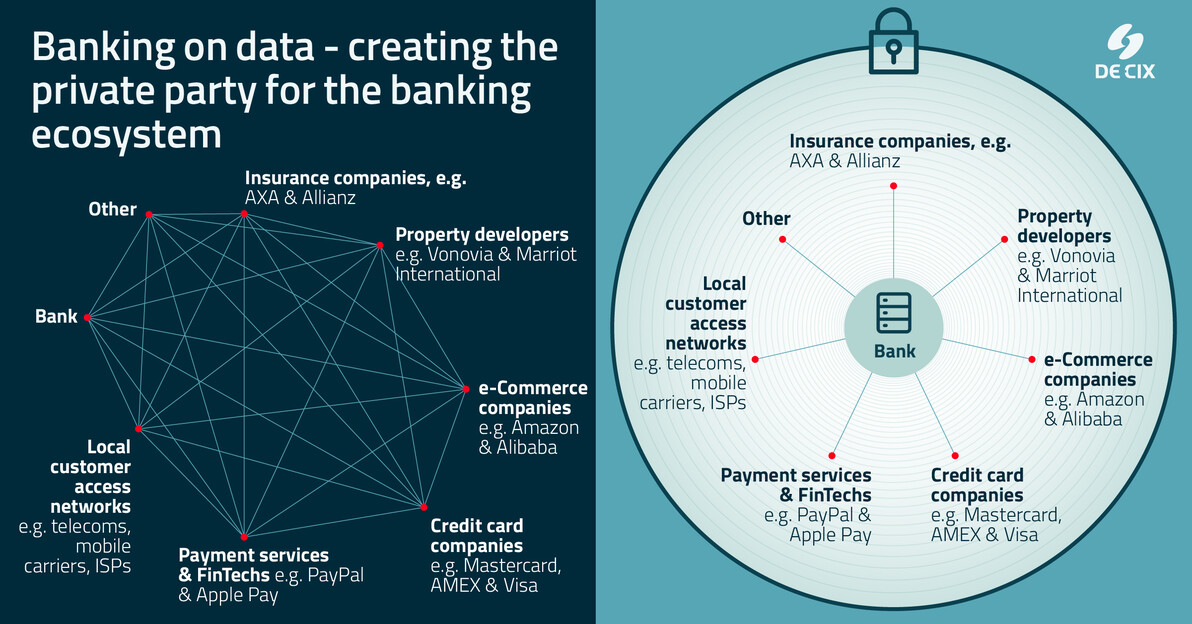

So, how can they achieve all this, given both the potential of digitalization and the need for risk mitigation? They need to bank their data with the same level of control as their money. They need to gain control over the digital infrastructure they use to connect to their entire digital ecosystem – from their cloud and connectivity partners through to their financial services partners, vertical industry partners, and customers. They need to connect their network directly to the networks of their many partners, in order to exchange data in a fast, efficient, flexible, and secure way. This is what is known as ‘interconnection’ – and for the best results, banks need to ensure direct interconnection to other networks1, and have this under their own control. With the right interconnection strategy, the challenges of digitalization can also be overcome for the banking sector, unleashing a new era of truly digital banking.

The secure private party for data management – the closed user group

Interacting with a larger group of stakeholders requires a new approach to interconnection. The broader the ecosystem is, the higher the demand is for flexibility, reduced complexity, and compliance management. Looking at this from the infrastructure perspective, this means the bank’s ecosystem needs to be interconnected in a very smart, efficient, and seamless way. This will make it possible to manage the complexity of the environment, as well as being able to manage compliance.

Banks already have very secure networks themselves, but once data leaves their network, it is generally either vulnerable or it is cost-intensive to protect. Traditionally, banks connect to important individual external networks via Multiprotocol Label Switching (MPLS)2 using intransparent ‘IP transit’.3 However, MPLS is expensive and inflexible, and does not scale well to a larger number of partner networks. Meanwhile, IP transit has limited or no control of traffic patterns, and entails a higher security risk than interconnecting directly with partners. For those networks to which the bank does not use MPLS – such as connections to clouds, applications, partner networks, and even customers – the data will generally be routed over the public Internet, exposing it to a range of risks.

If, instead, a bank builds its own private special-interest connectivity ecosystem – known as a ‘closed user group’ – on a secure and high-performance interconnection platform, it can bypass the public Internet and connect its network directly to the networks of its trusted partners and customers, and have high-speed, secure, and flexible access to its digital resources and enterprise-grade applications in the cloud, reducing the costs for connectivity.

To visualize the concept of a ‘closed user group’, think of a private room in a restaurant, where you can stipulate the menu and the dress code, and can play host to your invited guests, while the security ensures no uninvited guests can enter. Here, you can share anecdotes and exchange information with your partners in a private environment. What’s more, exchanging data with trusted partners over a distributed data center and carrier neutral interconnection platform avoids vendor lock-in.

The goal of this evolutionary transformation is that banks can support the needs and desires of their customers seamlessly and across sectors, through the entire lifecycle of the customer. In the process of this transformation, banks will need to transform from simply being investors and consultants for digital infrastructure companies to becoming operators of their own digital infrastructure. The more risk-averse and the larger the bank, the longer this transition will require, so it is necessary to test, to gain experience, to understand the benefits of gaining control over interconnection, and to develop your long-term interconnection strategy. This strategy must involve, firstly, ensuring seamless interconnection to internal resources. It must also consider compliance and risk mitigation, and secure connectivity to external partners and customer access networks. Finally, it should provide a framework for developing new revenue streams on the basis of the opportunitites that such connectivity and the resulting data avails.

If banks want to maintain their dominance in the financial sector, they need to secure and control their network interconnections so that they can develop new revenue streams and business models. What used to be the best connectivity option in the past can no longer fulfill the needs of modern banking. Creating a secure and private special-interest ecosystem on a high-performance, a data center and carrier neutral interconnection platform is an essential step in the journey towards to future of banking.

--

1Also known as ‘peering’

2Multiprotocol Label Switching (MPLS) has been used for the past two decades for enterprises and banks to connect their branch offices to their headquarters. By labelling each data packet, MPLS allows critical data to be prioritized for transport. However, it is extremely inflexible, with waiting times of weeks to months for the implementation of an MPLS circuit.

3In IP transit, a customer (here, the bank) orders a bandwidth of connectivity to the Internet via a carrier or telecommunications provider. This transit provider then connects to other networks in order to pass data traffic through the public Internet. Downsides to IP transit include the cost and the fact that, because the telecommunications provider cannot connect to the entire set of networks that make up the Internet, the data traffic will be sent via multiple further networks across the Internet to reach its destination, with no control over the routing – therefore reducing both the speed (latency) and the security of the data traffic.